Step into the exciting world of bitcoin investment at BitcoinInvestment.Finance! We’re here to guide you—whether you’re new to crypto or a pro looking to level up. Bitcoin, born in 2009 by the enigmatic Satoshi Nakamoto, is more than just a currency; it’s a revolution. Running on a decentralized blockchain, it lets you take charge of your money, free from banks and inflation worries. With its value skyrocketing over the years, it’s no wonder people are talking. We’re passionate about helping you tap into this potential with easy-to-follow advice and support.

1.1 million BTC

Year of Last Bitcoin Expected

Around 2140 or later

Why Invest in Bitcoin?

Think of bitcoin as your financial sidekick. Its capped supply of 21 million coins mimics gold’s scarcity, pushing its value higher as demand grows. No central bank meddling or hidden fees—just pure freedom. Big players like companies and investors are jumping in, making it a hot topic. At BitcoinInvestment.Finance, we see it as a chance to diversify your savings, whether you’re planning a big trip or securing your retirement. It’s about empowerment, and we’re excited to help you get there!

Bitcoin isn’t just a buzzword — it’s a proven, decentralized asset with strong long-term growth. Over the last decade, Bitcoin has outperformed traditional investments like stocks, gold, and real estate.

Key Benefits of Bitcoin Investment:

Decentralized & Transparent: Not controlled by any bank or government.

Inflation-Resistant: Limited supply (only 21 million Bitcoins will ever exist).

High Growth Potential: Bitcoin has delivered exponential returns over time.

Global Liquidity: Easily bought, sold, and transferred worldwide.

Portfolio Diversification: A smart hedge against traditional market volatility.

At BitcoinInvestment.Finance, we provide expert guidance so you can invest with confidence — not confusion.

Think of Bitcoin as your financial sidekick. Its capped supply of 21 million coins mimics gold’s scarcity, pushing its value higher as demand grows—no central bank meddling or hidden fees—just pure freedom. Big players like companies and investors are jumping in, making it a hot topic at BitcoinInvestment.finance, we see it as a chance to diversify your savings, whether you’re planning a big trip or securing your retirement. It’s about empowerment, and we’re excited to help you get there!

Marks the mining of the first-ever block (the “Genesis Block”) by Satoshi Nakamoto—representing the birth of the Bitcoin network and foundation of blockchain technology.

Commemorates the famous transaction where 10,000 BTC were used to purchase two pizzas—the first documented real-world purchase made with Bitcoin, signaling its emergence as a medium of exchange.

Reflects Bitcoin surpassing the $1,000 mark for the first time, a breakthrough that gained widespread media attention and helped introduce Bitcoin to a broader audience.

A landmark bull run where Bitcoin’s price climbed to around $20,000—its then all-time high—firmly placing it on the global financial radar and attracting mainstream observers.

Highlights Bitcoin surpassing $60,000 while also being recognized as legal tender in El Salvador—marking significant institutional and sovereign-level adoption.

New All-Time High (~$124,000): Bitcoin reached a fresh record in August 2025 MarketWatchThe Economic TimesReuters+1Forbes.

U.S. Strategic Bitcoin Reserve: In March 2025, the U.S. established a Strategic Bitcoin Reserve to consolidate government-held Bitcoin as a national asset

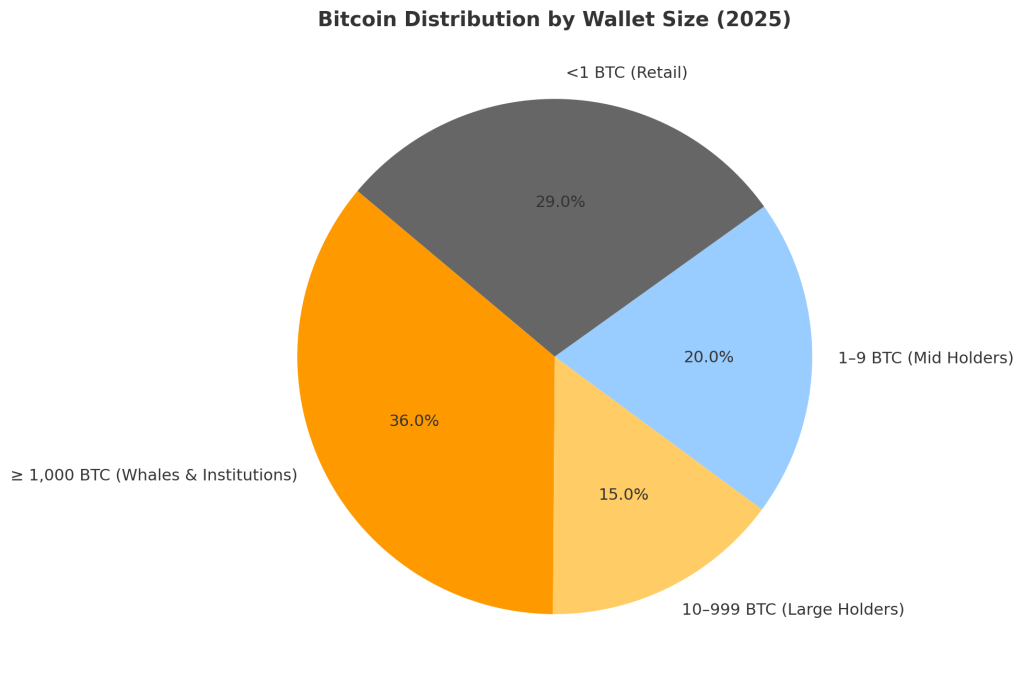

- Whales & Institutions (≥1,000 BTC): ~36%

- Large Holders (10–999 BTC): ~15%

- Mid Holders (1–9 BTC): ~20%

- Retail (<1 BTC): ~29%

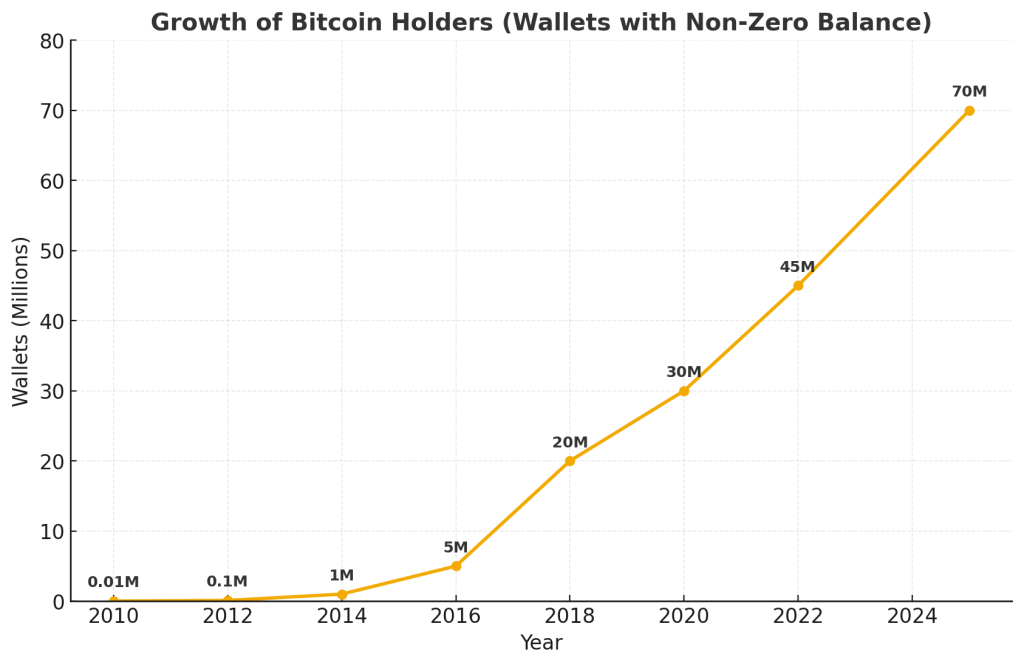

- 2010: ~0.01M (10k wallets)

- 2014: ~1M

- 2018: ~20M

- 2025: ~70M+

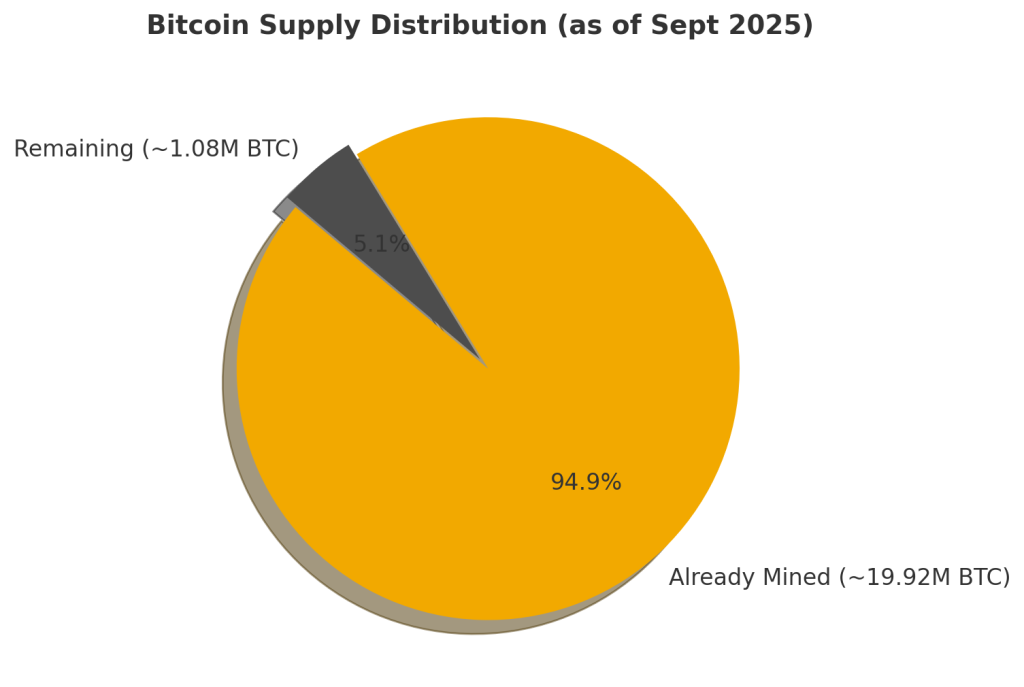

- 19.92 million BTC (94.9%) have already been mined

- 1.08 million BTC (5.1%) still to be mined

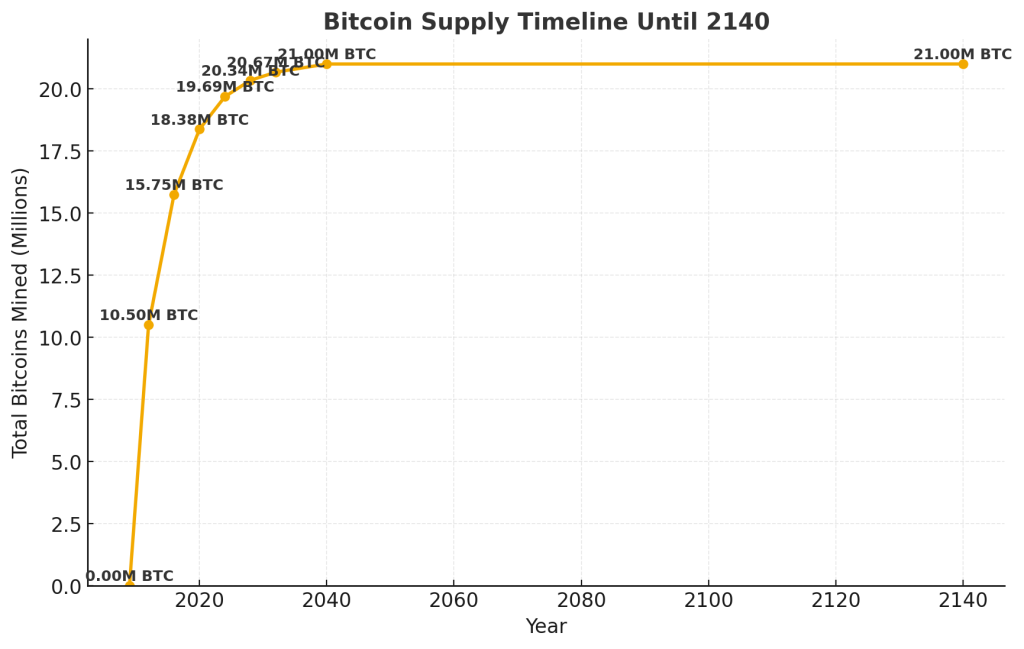

Here’s the Bitcoin supply timeline:

2009 → Mining began at 0 BTC.

2012 → ~10.5M BTC mined (first halving).

2016 → ~15.75M BTC mined (second halving).

2020 → ~18.37M BTC mined (third halving).

2024 → ~19.69M BTC mined (fourth halving).

2028–2032 → Over 20M BTC mined, very close to the cap.

2140 (estimate) → Final Bitcoin mined, reaching 21M BTC.

- This shows how new supply slows drastically with each halving, making Bitcoin scarcer over time.

Daily new Bitcoin entering circulation will be cut in half.

Annual issuance drops further, reducing inflation.

Mining becomes tougher since rewards shrink.

Miners rely more on transaction fees over time.

Historically, halvings have preceded major bull runs within 12–18 months.

Investor sentiment often turns bullish due to the supply squeeze.

By 2028, over 97% of all Bitcoin will already exist.

Only a very small fraction will remain to be mined across the next century.

This is why many call Bitcoin "digital gold" — fixed, scarce, and deflationary.

Expected Date

Around April 2028 (every 210,000 blocks, ~4 years).

Block Reward Change

Current (2024–2028): 3.125 BTC per block

After 2028 halving: 1.5625 BTC per block

Total Supply by 2028

~20.34 million BTC mined.

Remaining Supply

Less than 660,000 BTC left to be mined until the 21M cap.

~983,000 wallets; ~800–850k individuals

…Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua lorem ipsum

…Amet ipsum dolor sit amet, consectet urmagna elit, sed doipsum tempor incididunt ut labore et dolore magna aliqua lorem

Whoops, you're not connected to Mailchimp. You need to enter a valid Mailchimp API key.

Lorem Ipsum. Proin gravida nibh vel velit auctor aliquet. Aenean sollicitudin, lorem quis bi bendum auctor, nisi elit consequat ipsum, nec sagittis sem nibh id elit. Duis sed odio sit amet

Lorem Ipsum. Proin gravida nibh vel velit auctor aliquet. Aenean sollicitudin, lorem quis bi bendum auctor, nisi elit consequat ipsum, nec sagittis sem nibh id elit. Duis sed odio sit amet

Lorem Ipsum. Proin gravida nibh vel velit auctor aliquet. Aenean sollicitudin, lorem quis bi bendum auctor, nisi elit consequat ipsum, nec sagittis sem nibh id elit. Duis sed odio sit amet

WASHINGTON, DC 20037

NEW YORK info@domain.tld

SATURDAY: 11:00 – 17:00

SUNDAY: CLOSED

MOBILE: +1 916-875-2235

FAX: +1 916-875-2235